Latest from Technology

Sponsored

It’s not your father’s construction industry anymore. That’s for sure.

While many of the hands-on practices, equipment and project sites may still look broadly familiar to prior generations, the lifeblood of data and communications coursing among the trades and back and forth between jobsites and home offices might seem more like science fiction. But today’s younger HVACR professionals barely bat an eye at this tectonic transformation.

Indeed, technology has changed everything we do, and will continue to do so for the foreseeable future. So, it is useful to have some sort of barometer to measure periodically this constant change. Such research reassures some firms that they compare better to their competition than feared, while alerting others that it is definitely time for them to get with the program.

Over the last seven years, Bryan TX-based technology firm JBKnowledge Inc. (JBK), has increasingly filled that role, compiling an impressive body of research on industry tech use among subcontractors that has grown more authoritative and comprehensive each year. Taken together, the work provides a unique window on arguably the most dynamic part of our industry. Ironically, it is a role that the firm has now taken on almost by default.

“When we conducted the first annual survey in 2012, we were really just trying to get to know our construction clients better and confirm some suspicions we had around why technology wasn’t revolutionizing the industry as it should have been,” recalls Liz Welsh, editor-in-chief of JBK’s newly-released Seventh Annual Construction Technology Report, and the firm’s vice president of marketing. “I like to think that since that time, this survey and report has helped fuel that revolution. Every year, it’s amazing to see how the report sets new benchmarks for contractors to contemplate and aim for, based on how their peers are using technology.”

This latest report, the 2018 ConTech Survey closed in late August, fueled by responses from a record 2,821 industry participants, spread all across the U.S. For the first time, this year’s respondents included a substantial portion of electrical subcontractors, brought in with new sponsor NECA, the National Electrical Contractors Association. The group joined the research’s continuing sponsors led by the Mechanical Contractors Association of America (MCAA) and including the Construction Financial Management Association and Texas A&M University’s Construction Science Dept. Industry news source ConstructionDive also joined the sponsors this year.

All told, respondents to the 2018 survey confirmed that technology is now more ingrained than ever before in day-to-day activities. So much so, in fact, that nearly half of respondents now say that their firms have their own “dedicated IT department.” They are also more comfortable billing clients for related IT costs.

“The good news is that more and more companies are moving towards dedicated [in-house] ‘construction technologists,’” writes Welsh. “The bad news is their budget, and therefore scope, is still limited.”

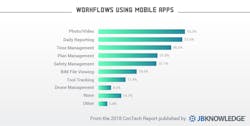

Specifically, the growing use of mobile apps on the jobsite was evident again this year. More than half of respondents reported using phones and tablets to take photos and record video to feed their daily reporting. And all manner of jobsite management, from time to safety to even drones, can be run via apps now.

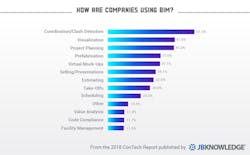

Building Information Modeling (BIM) File viewing is also another significant use for apps, amplifying the importance of BIM, itself. More than 60% of firms now report using BIM for project coordination and clash detection and nearly half use it for visualization and project planning.

Still, nearly 30% of respondents, roughly the same percentage as last year, say that they simply do not bid on projects involving BIM. So there is definitely still room for growth in this area, and in the opinion of JBK, money being left on the table

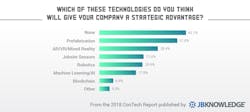

Looking ahead, the survey asked respondents what promise they saw in emerging technologies like augmented reality (AR) and virtual reality (VR) simulation, jobsite sensors, robotics, machine learning, and even blockchain purchasing. For now, though, most still did not see a strategic advantage in implementing these technologies just yet.

Commented one participant: “With the projected 40% of the construction workforce retiring within five years, we need to produce more with fewer workers. Therefore, we are making an investment into equipment that will allow us to pre-fabricate more and more of the typical plumbing and HVAC items.”

Data Security

On this pressing question, JBK reports that 14% of respondents said that they had suffered at least one data security breach in the 12 months prior to the survey. Another 8% were not sure, leaving 78% to claim that they had not suffered any breach in that time frame. JBK remains skeptical, citing broader AEC industry research that estimates more than 75% of all architects, engineers, contractors and subcontractors had been the target of a cyber attack in 2017-18.

With that in mind, JBK urges all AEC firms to explore Cyber Security Liability Insurance policies, “as more and more data and assets are stored digitally.”

“We’ve seen mobile importance grow, usage of software solutions plateau, IT staff remain over capacity, and confidence in implementing new technology fluctuate,” notes James Benham, CEO of JBKnowledge, in his concluding comments to this year’s report. “The influx of solutions, and investors in those solutions, since [the first survey in] 2012 means the AEC industry has more technology options and exposure than ever before. The problem remains that, as demand for IT tools grow, so too must our focus on existing IT resources, namely, the human ones.”

With that in mind, Benham reiterates his annual call for more creative tinkering in striving to remake and improve our work processes. “Create a culture of innovation,” he writes. “Start with yourself, then your department, then your leadership team, then your company—in whatever order makes the most sense for your role.”

The underlying notion is that such investment in creativity is no longer a luxury, if it ever was. On the contrary, it is now a competitive necessity and even a hedge against future economic slowdowns that could thin staffing and force even greater reliance on technology resources.

Indeed, that last line could be the real test to come for tech adoption. After all, the ConTech Survey has still never been conducted in a ‘down’ economic cycle. But many experts believe that the U.S. economy’s extraordinary, nine-year expansion finally will be challenged to last into 2020, at best. So, how will all of this new tech insulate your firm against the sort of buffeting that so shook our world a decade ago?

Seems like this might be a good time to find out.

To download the entire 69-page report for free, visit www.jbknowledge.com.