Latest from Business Development

eBook: Building Your Plumbing Business Brand

Sponsored

Online Exclusive: Accounting Basics for Small Contractors, Part 2

Second in a Series

In the first installment of this series we discussed the importance of having at least a basic understanding of accounting and financial concepts to properly operating a plumbing-heating-cooling (phc) business. We also covered a number of accounting terms and briefly discussed two of the basic financial statements: the income statement and balance sheet. In this installment, we’re going to go more in-depth on the income statement, look at its structure and explore company overhead.

Let’s review the definition of an income statement. An income statement (also known as a profit & loss statement or operating statement) is a financial statement that tracks the sales (revenue or income) and expenses (costs) of the company over a period of time (typically a month, a quarter or a year). An income statement tells the financial story of the company over that period of time. It’s like a movie. It tells you the sales made and expenses incurred during that time and whether or not a profit was made on those sales.

Exhibit 1 shows a sample basic income statement. The income statement includes the following components:

· Sales

· Cost of Sales

· Gross Profit

· Operating Expenses (or Overhead)

· Operating Profit

· Other Income/Expenses

· Net Profit

Sales (Revenue or Income)— This is the total amount of products and services sold after accounting for any sales discounts and returns.

Cost of Sales— You may also see this referred to as Cost of Goods Sold. However, since we primarily sell services, it is Cost of Sales in our industry. These are the direct costs attributed to the work performed. They include materials purchased, wages paid to perform the work, the payroll taxes and benefits associated with those wages, permit fees, equipment rentals and any miscellaneous job expenses.

Gross Profit— This is the amount that’s left after subtracting the Cost of Sales from Net Sales.

Operating Expenses (Overhead or Indirect Costs)— For many contractors, it’s easier to give examples of overhead expenses than it is to define the term. Overhead expenses are those expenses incurred by the business whether or not a job is sold. They are costs that can’t be assigned to any specific job. They don’t directly relate to the providing of a service or the installation of materials. They are the costs to maintain the business even if you weren’t doing any work.

You can’t directly charge a customer for an overhead expense like for repairs made to a service truck. For example, the service truck breaks down in Mrs. Brown’s driveway. You can’t charge Mrs. Brown for the cost of the truck repair because it broke down in her driveway. You have to spread that cost over all of your jobs.

Operating Profit (Operating Income)— This is the amount of profit left after deducting the operating expenses. It’s the profit generated from the operations of the business. It is often confused with Net Profit.

Other Income & Expenses— These are the items that are not directly related to the operation of the business. They include: accounts receivable service charges, investment and interest income, gains and losses on the sale of business assets, income taxes and miscellaneous income and expenses.

Net Profit (Net Income)— This is the amount left after adding other income and subtracting other expenses from the operating profit. It’s commonly referred to as the “bottom line” because it is the bottom line of the income statement.

In my opinion, the number one overhead item in a business is the owners’ salary. In my experience, this is the last item factored in for a contractor and the first item to be cut when the company struggles financially. Too many contractors don’t pay themselves a professional wage. When I ask how they determine their salary, too many of them tell me that they don’t take a salary. They just take whatever is left at the end of the year. The problem with that is that, far too often, there’s not much, if anything left at the end of the year!

This goes back to my comment in the previous article about people’s motivations for going into business for themselves. What’s the point of going into business for yourself if you’re not going to pay yourself more than you could make working for someone else?! Please remember this if you’re considering starting your own contracting firm and commit to paying yourself a professional salary on a consistent basis!

While owner’s salary is the number one overhead item, the overhead item that is most often overlooked in a company is depreciation. It’s also the expense that is a mystery to most contractors.

Depreciation is an accounting term that is often misunderstood. It is not an expense like fuel, office supplies or association dues where you actually pay out money. Depreciation is a non-cash expense on the income statement. You don’t write a check to anyone for depreciation. It is an expense that directly relates to the assets of the company and the fact that, over time, those assets lose value.

In an ideal setting, a company would set aside funds annually to cover the decline in the value of the company’s assets. Another way to look at it is as a reserve fund to cover replacing the company assets (i.e., vehicles, etc.). Please note: It won’t cover the actual replacement cost, and, remember, it’s a non-cash expense. In my experience, very few business owners actually do set aside funds on an on-going basis to replace their assets such as vehicles or equipment.

Let’s take a closer look at overhead expenses. There are two types of overhead expenses: fixed and variable.

Fixed overhead expensesare those expenses that remain the same regardless of the sales volume of the company. They don’t fluctuate. Examples of fixed overhead expenses include: administrative salaries, rent, utilities, dues and professional fees.

Variable overhead expensesare those expenses that can or do fluctuate in relation to the company’s sales volume. Examples of variable overhead expenses include: fuel, postage, office supplies, insurance and advertising.

While it’s important to understand the difference between fixed and variable overhead expenses, rarely are they listed that way on an income statement.

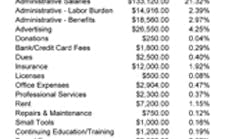

Exhibit 2 shows a much-more detailed income statement. Why is it important for a business owner to have an income statement that looks more like the one in Exhibit 2 rather than the one in Exhibit 1? The primary reason is that detailed income statements give the business owner more information and allows them to make more-informed business decisions.

The detailed income statement in Exhibit 2 shows the dollar amounts and percentages for 2012 and 2011 for the sample contracting company. It’s also known as a comparative income statement. In this case, it allows the reader to compare the results of 2012 with those of 2011. Comparative income statements can also be created comparing actual results of this year to the budgeted amounts for the year. Of course, in order to do this, the company must have created a budget for the year.

What’s the importance of creating a comparative income statement for the company? It allows the contractor to monitor how the company is performing throughout the year in comparison to the last month, the last year, against the budget or, if benchmarking data is available, to industry averages. If the company is not performing as well as expected in comparison to last year, the budget or industry averages, the contractor can make changes to improve his financial performance (i.e. more-informed business decisions).

Compare your income statement format to the ones included in this article. If yours looks more like the one in Exhibit 1 than Exhibit 2, talk to your bookkeeper or CPA about re-formatting yours to include more detailed information so that you can make more-informed business decisions.

In the next installment of this series, we’ll explore the balance sheet and statement of cash flows. We’ll also discuss the difference between profit and cash flow and how it’s possible for a contractor to go out of business at the most profitable time in the company’s history!

Michael Bohinc is a Certified Public Accountant in Cleveland, Ohio, and the owner of Keeping Score Inc. He has served as the Chief Financial Officer of Norhio Plumbing Inc., his family’s plumbing company in Aurora, Ohio, since 1988. He also currently serves as the Interim Director for the Service Nation Alliance – Plumbing Group. You may contact him via e-mail at [email protected].

Michael Bohinc | CPA and CFO

Michael Bohinc is a Certified Public Accountant in Cleveland, Ohio, and the owner of Keeping Score Inc. He has served as the Chief Financial Officer of Norhio Plumbing Inc., his family’s plumbing company in Aurora, Ohio, since 1988. A veteran speaker, he's trained hundreds of contractors in the basics of accounting and on fraud prevention. He also currently serves as the Interim Director for the Service Nation Alliance – Plumbing Group. He's also a die-hard Cleveland Indians fan. You may contact him via e-mail at [email protected].