Record Retention 101 for Contractors

By Audrey K. Kwak

There is no question that construction is a uniquely document-intensive industry. On every project, countless, lengthy, records are generated: contracts, specifications, daily reports, meeting minutes, schedules, requests for information, change orders—not to mention emails, text messages and so on.

Once a project is complete, the inevitable question arises as to how long (or if) these papers should be kept. Are electronic copies good enough? Or do you need the original paper versions?

Whether you are an owner, engineer, construction manager, general contractor, or subcontractor, record-keeping is one of the most often overlooked, but critical functions of the business. Every business should have a comprehensive, carefully considered record retention policy, drafted with input from human resources, information technologies, operations management, and legal counsel. The following is an industry-specific guide to the why and how of creating a record retention policy suited to your company.

Why a record retention policy is important

An effective document retention policy is essential to defending against a claim for liability arising from a project (or prosecuting your own), whether the claim is for delay damages, defective work, negligence, or otherwise. Claims may not arise until years after the project is over. Having a clear, documented record of how the project progressed is vital, especially if employees or other witnesses are unavailable, or have simply forgotten what happened and when.

How long to keep project records: general guiding principles

Perhaps the most critical component of any effective record retention policy is the establishment of the retention periods to apply to each category of business record generated by your company. Two jurisdiction-specific laws provide some rules of thumb to formulating appropriate retention periods: statutes of limitations and statutes of repose.

Statutes of limitations are time periods that limit when a party can sue. Generally speaking, they run from the date a defect has been discovered or an injury occurred. Since that date could occur long after the work has been completed, exposure to a claim arising from a project could, theoretically, last into perpetuity.

Statutes of repose were adopted to remedy this uncertainty. Unlike statutes of limitations, statutes of repose definitively bar claims after a set period of time, regardless of when a defect is discovered or an injury occurs. Most statutes of repose run from the date of substantial or final completion, though some statutes use other trigger dates (including written acceptance or occupancy). Most states (as of this writing, 46) have an applicable statute of repose, which range from four to fifteen years. For example, Massachusetts has a 6-year statute; New Jersey, Ohio and West Virginia have 10-year statutes; Pennsylvania has a 12-year statute.

As a rule, project-specific records should be kept three years beyond the expiration of the statute of repose.

Additional retention periods

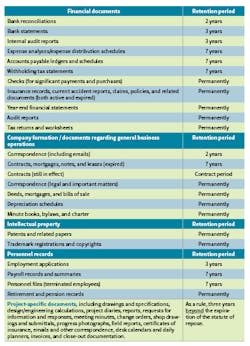

Of course, every business has to maintain records beyond project-specific documents. The below table has been compiled from a number of sources, including the Guide of Record Retention Requirements in the Code of Federal Regulations (“CFR”) (2 CFR § 200.333) (for any federal contracting work), IRS Regulation - 26 CFR 1.6001-1, IRS Publication 583, and others.

Note that these guidelines are only a starting point; you should consult with legal counsel to ensure that your retention periods are consistent with IRS regulations, and other federal, state and local government retention requirements before finalizing any retention periods. Provided the retention periods are in conformity with applicable guidelines, it is prudent to set retention periods to the minimum required, to minimize the risk of unauthorized access to data.

§ Federal statutes and regulations: e.g. the Sarbanes-Oxley Act (SOX); the CFR - Record Retention regulations generally: see www.ecfr.gov/cgi-bin/ECFR?page=browse; and IRS Regulations; and

§ State and local laws and/or regulations. Notably, as of this writing, seven states (Colorado, Georgia, Illinois, Maryland, New Hampshire, Oklahoma and Texas) have adopted the “Uniform Preservation of Private Business Records Act” or an equivalent law, which provides that whenever a law does not specify a retention period, businesses should keep their records for three years.

A thorough, thoughtful record retention policy is no small feat, but it is an essential component of every responsible company’s risk management arsenal. Equally important, regularly review and update your policy, as legal requirements and technologies evolve and change. Given the possible legal consequences of a weak or inadequate policy, it is prudent to consult with legal counsel at regular intervals both in drafting and updating your record retention policy, to ensure best practices and compliance with ever-evolving regulations, statutes, and case law.

Audrey Kwak is a Pittsburgh-based attorney with the law firm of Eckert Seamans Cherin & Mellott. She is an experienced litigator in the area of commercial business disputes, with a focus on handling high-stakes construction and commercial contract disputes. Her practice involves the representation of contractors, suppliers, and owners, including small business and disadvantaged business enterprises, service-disabled veteran-owned businesses, and women-owned small businesses.