Construction Contractors Lose Confidence in Q4

WASHINGTON, DC — Construction industry leaders remained predominantly confident about the nonresidential construction sector’s prospects during the final quarter of 2018, according to the latest Construction Confidence Index released by Associated Builders and Contractors.

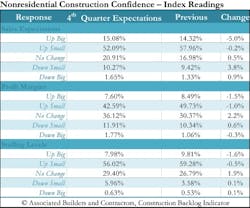

Sales expectations remained especially upbeat during the fourth quarter, though the proportion of contractors anticipating significant sales increases in the following two quarters dipped by five percentage points. Despite that, more than 67 percent of contractors projected rising sales, while slightly less than 12 percent expected sales to decline.

Just over 50 percent of contractors anticipate their profit margins to grow in the first half of 2019, yet only one in 10 contractors expects their profit margins to decline, even with rising labor costs. In addition, more than six in 10 contractors expect to increase staffing levels in upcoming quarters. Despite significant turmoil in the financial markets during last year’s final quarter, all three key components measured by the survey—sales, profit margins and staffing levels—remain well above the diffusion index threshold of 50, signaling ongoing expansion in construction activity.

· The CCI for sales expectations declined from 68.6 to 67.2 during the fourth quarter of 2018.

· The CCI for profit margin expectations fell from 63.6 to 60.6.

· The CCI for staffing levels decreased from 68.6 to 66.2.

“Despite rising materials costs, an ongoing skills shortage and higher borrowing costs, CCI continues to indicate optimism in America’s construction sector,” said ABC Chief Economist Anirban Basu. “Construction industry leaders expect profit margins will hold up well during the first half of 2019 despite these rising costs, which speaks to the ongoing strong demand for construction services.

“This is especially important as a number of other indicators have reported waning confidence, such as the University of Michigan’s Consumer Sentiment Survey and NFIB’s Small Business Optimism Index. While risks remain, this suggests the nation’s nonresidential construction segment remains more stable than others. However, there are many unknown factors, including trade negotiations, rising interest rates and the potential for comprehensive infrastructure spending, which can have a significant impact on contractor confidence this year.”

CCI is a diffusion index. Readings above 50 indicate growth, while readings below 50 are unfavorable.

Editor’s note: ABC’s Construction Confidence Index will be reported monthly beginning with January 2019 data. The first monthly CCI release is scheduled for March 21. Find the full schedule of ABC 2019 economic releases at abc.org/economics.