Online Exclusive: Accounting Basics for Small Contractors — The Balance Sheet

Previously, we discussed some ways to improve cash flow within a company. This evolved from a question that was posed by contractors on a message board regarding the difference between profits and cash. Now, let’s go back and take a detailed look at the balance sheet as previously promised.

What is the balance sheet? It’s the financial statement that summarizes the company’s assets, liabilities and equity at any moment in time. It is also the accounting equation in financial statement form. It is expressed as:

Assets = Liabilities + Owners’ Equity

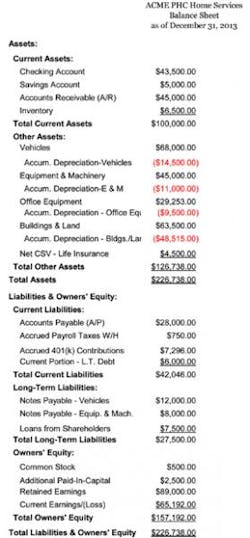

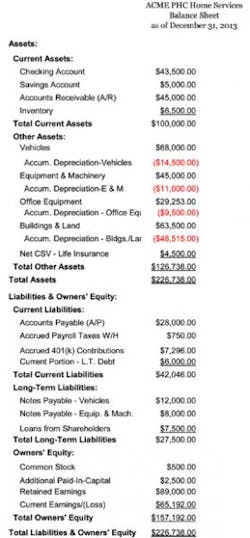

This equation must always be in balance. Always! (Hence the name balance sheet.) A sample balance sheet is included with this article for you to use as a reference to see what a basic balance sheet for a contractor might look like.

Let’s take a look at each of the components of the balance sheet. You can click on the thumbnail to see the full-size PDF.

Assets are the things that a company owns. Some examples of assets are cash, inventory, accounts receivable, vehicles and goodwill.

There are current assets and long-term assets. By their nature, current assets are more liquid than long-term assets. They are assets that can be quickly converted to cash or are expected to be used within the next year.

Current assets include cash, accounts receivable, inventory and prepaid expenses like insurance.

Cash or bank accounts are most liquid. Accounts receivable are next liquid as they can be readily turned into cash over a short period of time, assuming that they’re collectible (i.e., not bad debts). Inventory is next in line of liquidity. It would take some time to sell off the inventory to convert it to cash unless you have a “fire sale.”

A “fire sale” is a sale of inventory at deeply discounted prices to convert it to cash. This should be avoided at all costs as you will get a significantly reduced amount of cash compared to the value of the inventory items. In a fire sale, you may get 25 to 50 cents on each dollar of inventory.

Long-term assets are the other assets of the company. They are the assets that aren’t expected to be converted into cash or used up in the next year. Long-term assets include vehicles, equipment, machinery, long-term investments, buildings, land and goodwill. By their nature, long-term assets are less liquid than current assets.

On the other side of the balance sheet, or equation, lie the liabilities and owner’s equity of the company.

Liabilities are the debts the company owes. Some examples are accounts payable, payroll taxes payable and loans payable.

Similar to assets, there are current and long-term liabilities.

Current liabilities are those liabilities of the company that are due or expected to be paid within the next year. Examples include accounts payable, accrued payroll taxes, bank line of credit amounts and the current portion of long-term debt.

Long-term liabilities are the other liabilities of the company. These are the obligations that are due longer than one year from now. Examples include loans payable (i.e., principle payments on loans that are due longer than a year from now) and loans from shareholders.

Owner’s Equity is the amount of assets left over after all the liabilities of the company are paid. It has a number of components to it. One component is the capital account (sometimes referred to as Common Stock). It is the amount of money the owner initially contributed to the company as well as any other amounts invested at a later point in time.

A second component of owner’s equity is the retained earnings account. It is the accumulated profits and losses of the company since the company was started. The balance is adjusted based on the profit or loss for the company each year.

The final component of owner’s equity is the draw or distribution account. Sometimes there will be a separate account created to track amounts distributed to the owner from the company. Sometimes, these distributions are simply tracked through the retained earnings account.

It’s important to note that there is another type of account often found on the balance sheet. They are “contra accounts.” Contra accounts are those accounts that are opposites of other accounts on the balance sheet. They give the rest of the transaction story regarding a specific balance sheet account. Common “contra” accounts include accumulated depreciation, which is the contra account to the company’s vehicle, equipment or other property valuation. It reduces the overall value of the assets on the books.

Assets normally carry debit balances. Contra asset accounts like accumulated depreciation carry credit balances. The same holds true for the liability and owner’s equity side of the balance sheet. Liabilities and owner’s equity accounts normally carry credit balances. Contra liability and owner’s equity accounts carry debit balances.

The most common contra account found on this side of the balance sheet (liabilities & owner’s equity) is the owner’s draw or distribution account (as mentioned above). It carries a debit balance. That is contrary to the normal credit account balance that owner’s equity or a liability account carries.

These three sections (Assets, Liabilities and Owner’s Equity) combine to make up the balance sheet. The balance sheet shows you the things you have in your business. Then, it connects those things you have to the people who own them or have a claim to them. A balance sheet shows you what you own and who you owe. It’s like a snapshot or picture of the business because it relates to a specific point in time of the business (i.e., as of the date of the balance sheet).

Contractors used to get balance sheets for their company from their accountant or bookkeeper once a year or maybe quarterly if the contractor requested it. Now, with the advent of computer software, a balance sheet can be generated at any time. This makes it easier for the contractor to monitor his financial statements. I recommend that contractors review their balance sheet, along with the other financial statements, on a weekly basis.

Michael Bohinc is a Certified Public Accountant in Cleveland, Ohio, and the owner of Keeping Score Inc. He has served as the Chief Financial Officer of Norhio Plumbing Inc., his family’s plumbing company in Aurora, Ohio, since 1988. He also currently serves as the Interim Director for the Service Nation Alliance – Plumbing Group. You may contact him via e-mail at [email protected]

About the Author

Michael Bohinc

CPA and CFO

Michael Bohinc is a Certified Public Accountant in Cleveland, Ohio, and the owner of Keeping Score Inc. He has served as the Chief Financial Officer of Norhio Plumbing Inc., his family’s plumbing company in Aurora, Ohio, since 1988. A veteran speaker, he's trained hundreds of contractors in the basics of accounting and on fraud prevention. He also currently serves as the Interim Director for the Service Nation Alliance – Plumbing Group. He's also a die-hard Cleveland Indians fan. You may contact him via e-mail at [email protected].