Latest from Construction Data

Sponsored

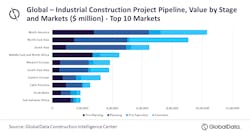

North America Dominates Global Industrial Construction Project Pipeline

North America dominates the global industrial construction project pipeline, accounting for 21.7% or $1.03 billion of the pipeline in Q4 2022, an increase of 5.1% from the previous quarter, says GlobalData, a leading data and analytics company. GlobalData notes “re-shoring” and large-scale stimulus packages in the US have accelerated the pipeline of industrial projects in North America.

GlobalData’s latest report, ‘Project Insight - Industrial – Q1 2023’, reveals that the US dominates the project pipeline in North America, representing 84.9% of the pipeline, with the total value of projects amounting to $876.2 billion.

Jack Riddleston, Construction Analyst at GlobalData, comments: “In terms of pipeline value, North America has accelerated away from North-East Asia, which holds the second-largest industrial project pipeline. Major project announcements in Q4 2022, such as the $12 billion Phoenix Chip Manufacturing Plant in Arizona, US, and the $10.6 billion Mazda Electric Vehicle Production Facility in the US, have largely driven the sizable increase in the North American pipeline. Whereas, in North-East Asia, the pipeline has marginally contracted 0.9% from the previous quarter, with the total pipeline value equating to $907.4 billion or 19.1% of the global project pipeline.”

Based on GlobalData’s analysis of the industrial construction projects currently in the pipeline in North America, construction spending will reach $194.8 billion in 2023, if all projects go ahead as planned and spending is evenly distributed over the construction stage.

GlobalData is currently tracking industrial construction projects in North America with a total value of $1.03 trillion. Projects in the pre-execution and execution stages account for 37.6% of projects in the pipeline, whereas in North-East Asia this figure is 44.8%, indicating a higher percentage of projects are in the early stages of development in North America.

Riddleston continues: “A spur in growth in the US project pipeline is largely due to “re-shoring” and increased dynamism to move technology supply chains away from Asia and China in particular. Trade disputes with China and Net-Zero targets have galvanized the Biden administration to ramp up investment into green technology such as electric vehicle manufacturing and advanced technology production."

In mid-2022, the US government passed two major stimulus packages; the CHIPS and Science Act (which will put around $80 billion in Semi-conductor Manufacturing), and the Inflation Reduction Act (which will put $369 billion into Energy and Security and Climate change initiatives over the next 10 years, including EV manufacturing subsidies and many others).

As a result of new funding for new projects being given the green light; the US semiconductor manufacturer SkyWater Technology announced plans in mid-2022 to build a $1.8bn semiconductor R&D and production facility in Indiana, in partnership with the state and Purdue University and construction expected to commence in Q3 2024.

Riddleston concludes: “Furthermore, major projects such as the $5.5 billion Savannah Electric Vehicle and Battery Manufacturing Facility in Georgia, US and the $5.0 billion Sherman 300 MM Wafer Manufacturing Plant in Texas, US broke ground over the past quarter as construction activity commenced on each project.”