Latest from Construction Data

Sponsored

As we head into 2023, the economic picture is murky. While the US recorded negative GDP in the first two quarters of 2022 (putting us unofficially in a recession), Q3 marked an increase in GDP of 3.2%. Employment levels remain high (with the official unemployment rate as of December 2022 just 3.5%), with a concomitant upward pressure on wages. Inflation also remains stubbornly high and the supply chain—while improved from a year ago—shows some persistent problems.

Paradoxically, the general mood in the construction industry is positive, with most builders showing record backlogs (in December, ABC’s Backlog Indicator reached its highest level since Q2 of 2019), and moderate-to-high confidence in the business outlook for 2023.

The Inflation Situation

The lead economic story for 2022 was inflation, and the Federal Reserve’s efforts to keep it under control. Over the 12 months ending in June 2022, the Consumer Price Index for all urban consumers increased 9.1%—the largest 12-month increase since the 12-month period ending November 1981. In response, the Fed hiked the Federal Funds Rate seven times in 2022. The rate now stands at 4.25%-4.50% pushing borrowing costs to the highest level since 2007.

While the stock market has seen some steep sell-offs, most of the Fed’s moves have been in line with market expectations. Fed Chairman Jerome Powell has made it clear (well, clear for a professional economist) that the Fed is willing to risk, or even cause a recession if that’s what it takes to bring inflation under control. (And history bears this out; the Fed triggered two recessions in the 1980s as a direct result of its inflation-fighting policies.)

“The Federal Reserve’s ongoing battle with inflation has raised concerns that a recession is imminent in the new year,” said Richard Branch, chief economist for Dodge Construction Network during the 2023 Dodge Construction Outlook delivered on November 15, 2022. “Regardless of the label, the economy is slated to significantly slow, unemployment will edge higher, and for parts of the construction sector it will feel like a recession.

“Next year, however, will not be a repeat of what the construction sector endured during the Great Recession when the financial system collapsed. Residential construction, already reeling from rising mortgage rates, will continue to contract and will be joined by nonresidential construction as the commercial sector retrenches. The funds provided to the construction industry through the Infrastructure Investment and Jobs Act (IIJA), The CHIPS and Science Act, and the Inflation Reduction Act (IRA) will counter the downturn allowing the construction to tread water. During the Great Recession, there was no place to find solace in construction activity—2023 will be quite different.”

The Construction Market

One of the most reliable leading indicators, the Architecture Billings Index (ABI), has only recently shown signs of a slowdown. After architecture firms experienced their first decline in billings in nearly two years in October of 2022, business conditions softened further in November as the ABI score fell to 46.6 (any score below 50 indicates a decline in firm billings). While inquiries into new projects continued to rise modestly, the value of new design contracts also declined further in November.

Moving from the buyers and architects to the builders themselves, Associated Builders and Contractors reported in November 2022 that its Construction Backlog Indicator declined to 8.8 months in October, according to a member survey conducted Oct. 20 to Nov. 4. The reading is 0.7 months higher than in October 2021.

After surpassing its pre-pandemic level in September, backlog is now back below the reading observed in February 2020. Backlog in the commercial and institutional category posted its largest monthly decline since July 2020 and is now 0.4 months below pre-pandemic levels.

At the same time, ABC’s Construction Confidence Index reading for sales increased in October, while the readings for profit margins and staffing fell. All three readings remain above the threshold of 50, indicating expectations of growth over the next six months.

“October’s survey data hinted at some emerging weakness in the nation’s nonresidential construction sector,” said ABC Chief Economist Anirban Basu. “While the industry continues to gain strength from significant funding for public work, pandemic-induced behavioral shifts—including remote work and online business meetings as well as surging borrowing costs—are translating into meaningful declines in backlog in commercial and institutional segments.”

The Dodge Industry Forecast offered these predictions for 2023:

- The dollar value of single-family starts will be flat (-5% when adjusted for inflation), however, units will be down a further 6% to 891,000 units (Dodge basis) as higher mortgage rates and worsening affordability eat away at demand

- The multifamily sector has been reaping the benefits of the affordability issues plaguing the single family market, pushing demand for space up and vacancy rates down to record lows. The softening labor market and investment outlook will eat away at these gains in 2023. While the dollar value of multifamily starts will rise a scant 1% (-7% when adjusted for inflation), units will fall 9% to 723,000;

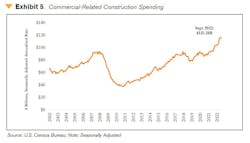

- Commercial starts will fall 3% in 2023 (-13% when adjusted for inflation) led by pullbacks in warehouse and office sectors. Hotel and retail starts will post tepid growth in nominal dollars, but when adjusted for inflation will also slip; but the declines will not be as dramatic as in office and warehouse. There is some positivity in the commercial space in 2023, though, as data center construction is expected to remain brisk;

- Institutional starts, meanwhile, will hold steady in 2023 (-1% inflation-adjusted) as gains in healthcare offset losses elsewhere. Traditional education starts (classrooms) have languished as slow demographic growth eats away at overall demand, however, life science buildings have flourished and will continue to do so in the new year. Healthcare starts will be the engine of growth in the institutional sector as greater demand for both outpatient clinics and hospitals is on the rise;

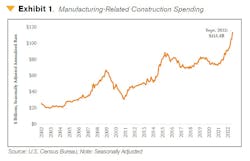

- Manufacturing starts have been robust since the pandemic as reshoring has led to numerous chip fabrication plants, EV battery plants, and other large facilities breaking ground. Manufacturing starts are expected to nearly triple in 2022, and while they will decline in 2023 the level of 2023 starts at $51 billion has not been seen since the beginning of Dodge’s historical starts time series in 1967. The CHIPS and IRA acts will support abnormally high levels of activity for years to come;

- Nonbuilding/infrastructure grouping of projects will be supported by an infusion of public dollars through IIJA. Public works starts will gain 18% in 2023 (+12% adjusted for inflation) led by gains in streets and bridge work, while the utility/gas category will gain 8% (+2% inflation-adjusted) as the extension of the investment and production tax credits in IRA will lead to gains in utility-scale wind and solar projects.

Materials

It is difficult to disentangle inflation from other factors—the availability of raw materials, supply chain disruptions—that affect the price of necessary tools, equipment and supplies.

The price of gasoline is a chief concern for anyone managing a fleet, or who uses supplies shipped by truck (i.e., everyone). Global recession fears have pushed the price of crude oil down, despite continued stable consumption in the US. Petroleum production in the US is still trending slowly toward the 13-million barrels-per-day benchmark, and products used in petroleum production should remain in stable demand despite falling crude oil prices.

The Strategic Petroleum Reserves continue to be at historically low levels (the lowest since 1984) and at some point, the US will have to rebuild those inventories in 2023, pushing prices up above normal supply/demand market condition rates when it occurs.

In its November 2022 Commodity Report, the American Supply Association found (when compared with October), no increase in the price of thermoplastics. As for cast-iron, both Tyler and Charlotte Pipe reported no changes regarding cast-iron pipe, fittings and/or couplings-gaskets for the month.

Carbon steel hot-rolled coil pricing continues to fall. Lead times also have fallen on HRC from four weeks to three weeks. Steel pipe pricing has maintained relatively flat despite the erosion of carbon steel commodity prices.

The price direction of stainless-steel welded pipe has long been driven primarily by the price of nickel. Nickel was regarded as the most volatile base metal before the historic short squeeze occurred on the London Metal Exchange (LME) last March. Since that time, LME trading volumes have fallen sharply. October’s daily average trading volumes were down 54% year-on-year and represented the lowest monthly trading activity in at least a decade. The lack of trading volumes continues to add volatility.

But a snapshot in time cannot tell the entire picture. “We continue to expect pressure from high inflation, supply chain constrains, and some specialty raw materials,” Andres Caballero, President of Uponor, North America, said in response to questions from CONTRACTOR. “Our priority is to continue to provide the highest quality product for water solutions that customers in North America and around the world come to expect from Uponor. We will look into market dynamics proactively as we consider possible price actions while ensuring customers get the most value from our products and solutions.”

When asked about price increases for water heating equipment in the coming year, Noritz's Executive VP and General Manager, Jason Fleming, said, “This has not been decided yet, but we are doing our best to keep pricing consistent, as everyone is facing cost challenges, and increased prices will present more. If we continue to see increases [in raw materials costs], we will need to plan accordingly.”

Labor and Productivity

Employers added 223,000 jobs in December of 2022, finishing a year in which the economy added 4.5 million jobs, refilling the hole left by the coronavirus pandemic. Hiring has slowed since the first half of last year, when employers were adding more than 400,000 jobs a month, on average, and a continued slowdown is expected.

But the tight labor market has hit the skilled trades harder than other sectors. According to a recent story on NPR.org, the application rate for young people seeking technical jobs—like plumbing, building and electrical work —dropped by 49% in 2022 compared to 2020 (based on data from online recruiting platform Handshake).

Despite local, state and federal money for skills training, and despite numerous shops around the country offering “earn-while-you-learn” programs, the skilled trades still face an image problem that makes attracting the Millennial and Gen Z cohorts difficult. At the same time, the Baby Boomers continue to retire; 75 million are expected to leave the workforce by 2030, paving the way for what some are calling “The Great Retirement.”

In response, many manufacturers are offering products and services designed to boost productivity, allowing contractors to accomplish more work even with fewer hands. For example, Uponor has begun offering a kitting service that provides customized, coordinated packaging with select products, a materials list, plan view, and 3D isometric drawing in individual packets delivered directly to the job site. The service is idea for buildings with high repeatable room types, such as apartments, condominiums, dormitories, hotels, assisted-living centers, and hospitals.

In a year-end address, Jim McGoldrick, Senior Vice President, Sales, for Bradford White, stressed the company’s focus on delivering innovative solutions, saying, “Bradford White’s vision for the next 30 years and beyond is staying laser-focused on innovation and providing the solutions our customers need.”

Steve Spaulding | Editor-inChief - CONTRACTOR

Steve Spaulding is Editor-in-Chief for CONTRACTOR Magazine. He has been with the magazine since 1996, and has contributed to Radiant Living, NATE Magazine, and other Endeavor Media properties.