Latest from Construction Data

Sponsored

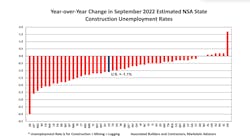

WASHINGTON, DC — The not seasonally adjusted national construction unemployment rate dropped 1.1% in September 2022 from a year ago, down from 4.5% to 3.4%, according to a state-by-state analysis of U.S. Bureau of Labor Statistics data released today by Associated Builders and Contractors. Forty-two states had lower unemployment rates over the same period, Arkansas and Wisconsin were unchanged and six states were higher. Almost half of the states had estimated construction unemployment rates at or below 3%.

National NSA payroll construction employment was 282,000 higher than in September 2021. From March through September of this year, seasonally adjusted construction employment has been above its February 2020 pre-pandemic peak (7,624,000) except for a slight dip in April. As of September, it was 95,000 greater than its pre-pandemic peak.

Residential construction employment has fully recovered, while nonresidential construction employment is still below its pre-pandemic peak. September SA residential payroll construction employment was 162,000 above its pre-pandemic peak while nonresidential payroll construction employment was 67,000 below its pre-pandemic peak.

The September 2022 national NSA construction unemployment rate of 3.4% was up 0.2% from September 2019. However, over that same time period, 29 states had lower construction unemployment rates, two were unchanged and 19 states had higher rates.

“Higher interest rates are having a negative effect on plans for new construction projects; nonetheless, construction employment continues to rise as builders work on their backlog of projects,” said Bernard Markstein, president and chief economist of Markstein Advisors, who conducted the analysis for ABC. “Further, builders are still reporting a shortage of skilled workers. Although employers want to hold on to their workers, slowing demand for new projects along with completion of older projects eventually is likely to force some contractors to reduce their workforce. At the same time, construction employment will be helped by spending on projects implemented through the Infrastructure Investment and Jobs Act.”

Recent Month-to-Month Fluctuations

National and state unemployment rates are best evaluated on a year-over-year basis because these industry-specific rates are not seasonally adjusted. However, due to the changing impact of COVID-19 and other national and international disruptions, month-to-month comparisons offer a better understanding of the rapidly shifting economic environment on construction employment.

Thirty-three states had lower estimated construction unemployment rates than in August, 14 states had higher rates and three (Iowa, South Carolina and Wisconsin) had the same rate.

The Top Five States

The five states with the lowest September 2022 estimated NSA construction unemployment rates were:

1. North Dakota, 0.6%

2. Colorado, 1.1%

3. Utah, 1.2%

4. South Dakota, 1.5%

5. Tennessee, 1.8%

All five states posted their lowest September estimated NSA construction unemployment rate on record.

The Bottom Five States

The states with the highest September 2022 estimated NSA construction unemployment rates were:

46. Rhode Island and Wyoming (tie), 4.9%

48. Ohio, 5.5%

49. New Mexico, 5.9%

50. Alaska and Oklahoma (tie), 6.8%

This was the fifth consecutive month that all states had construction unemployment rates below 10%. Rhode Island posted its second lowest September estimated construction unemployment rate on record. Wyoming had the largest monthly decline among the states, down 2.7% from August. Alaska had the largest year-over-year decline in its unemployment rate among the states, down 4% from September 2021.

To better understand the basis for calculating unemployment rates and what they measure, check out the Background on State Construction Unemployment Rates.

Visit abc.org/economics for the Construction Backlog Indicator and Construction Confidence Index, plus analysis of spending, employment, job openings, GDP and the Producer Price Index.