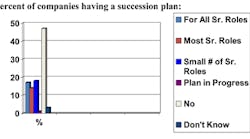

These statistics from a recent survey, say a lot:

Here are some other vital statistics: 30% of family-owned businesses survive into the second generation, 12% into the third, and 3% into the fourth. Sixty percent do not have a full and active succession plan. It’s pretty believable, considering that the baby boomer generation is at or near normal retirement age. And about 50% have not yet thought about a choice of successor, in other words, handing over the reigns.

Succession planning is a process

What should we conclude from this? That owners are in danger of having worked all their lives creating, building and running a business, only to have it fall into limbo come their desire to retire or their untimely death or disablement?

Succession is a once in a lifetime event. Often, it's often fraught with emotional issues for all family participants (sometimes even for employees), financial issues and ultimately stressful to the family as well as the family business. Good reasons to look at succession planning as a process rather than some singular event. There are many reasons (and too numerous to mention them all here) as to why companies don't have or fail at a succession plan. They include:

- Fear of discussing the future beyond the lifetimes of the owners.

- Fear of letting go and/or loss of a meaningful life.

- Norms against favoring siblings and difficulty in making hard choices.

- Feelings of entitlement among potential successors.

- Employees' fear of change.

- The roles of active versus passive family members.

- Spousal influences.

Companies have many choices, such as close the doors, sell to an outsider or employee, retain ownership (hire someone from the outside to run the business), retain family ownership and management control, or do nothing or minimal due-diligence, which leaves chaos behind.

All of these choices are usually cloaked in some economic or emotional decisions. It can get very complicated and beyond the scope of this article.

My own experience working with clients, though, is that the initial succession planning conversation almost always turns to the financial considerations: buy-sell agreements, taxation liabilities, estate planning and payouts that can impact cash and future expansion plans, etc.

These are surely not unimportant issues, and you should be consulting with your accountants and tax attorney, as to how best to secure your own and your company’s financial security.

Why does the initial focus turn to the financial? My findings indicate that most owners shy away from the sometimes difficult issues related to who the successor(s) will be. They fool themselves into believing that choosing the right successor is a slam dunk, particularly if it is someone in the family. They lose sight of the fact the definition of succession planning is really made up of two distinct parts — a science and an art — a transfer of assets to a successor or successors (the science) and a transfer of control to those best suited to exercise it (the art).

Four phases

Most succession plan advisors will tell you that if you plan early enough, the four phases to a successful succession plan are:

Initiation: When children, or others, begin to learn about the business and making decisions about coming into the business.

Education: Training and educating potential successors and providing a path to growth and responsibility.

Selection: Choosing who will be the successor(s), the company’s leader(s), in the next generation.

Transition: The timely, orderly and final transfer of control to a successor, which may also include the role, if any, of the current owner.

The K-S-Ps

The selection phase, I believe, is undoubtedly the most important, and sometimes may not be as obvious as you think, again, not the slam dunk you think it may be!

This is why I choose to redefine the definition of succession planning as: A purposeful initiative focused on leadership talent, regardless of whether the transition is to a family member, outside management, or, for that matter, just building bench strength (a talent pipeline) in your organization.

The critical competency in this selection phase is leadership competency. So you can’t ignore the "K-S-Ps," the three factors of knowledge, skills and personal attributes. It’s kind of like a balanced scorecard. Why? Because it offers clarity about what core competencies exist in an individual, a potential successor, or should, as well as identifies the gaps that may exist. It's not meant to be exclusionary, but you do need to understand them, be aware of them, in any potential successor, so they can be addressed, the earlier the better. Consider it part of their development.

Here are Definitions of the K-S-Ps.

- Knowledge: The sum of our experiences and what we know as it relates to the business, across sales, operations, finance and information technology, etc.

- Skills: How well one can apply what they know, in a productive way, otherwise there may be little result or execution.

- Personal attributes: This has to do with leadership style, emotional intelligence, behavioral style and attitudes. The type of personal skills required of leadership.

Frankly, I believe that personal attributes can be a limiting factor, and often ignored. They are often overlooked because of chemistry, relationships or we just choose to. Where knowledge and skills can be learned or taught, personal attributes are effectively who we are. Awareness and change may be required.

So as part of the selection phase, you should benchmark the specific criteria, such as those below, and the degree to which one must possess these attributes:

- Motivation, drive and competitiveness: The drive to succeed, innovation and out-of-the-box thinking.

- Results and goal orientation as opposed to just doing things (tasks).

- Interpersonal skills.

- Communication and persuasiveness: The ability to influence others is a major personal attribute.

- Emotional intelligence: The ability to facilitate high levels of collaboration and productivity.

Do yourself a favor, because there is no reason to go it alone. Obtain a family business analysis by working with someone, such as a consultant or a trusted advisor, etc., knowledgeable about succession planning, who understands the emotions sometimes present, the broader implications of change, and can help you, as well, facilitate the succession planning and implementation issues. They can bring and maintain an objective view of how your company works. You may be too close to it to objectively and completely understand the personal goals, aspirations and competencies of potential successors. In other words, understanding the players and what they bring to the table.

Use one of the many assessment tools that exist in the marketplace today that can help you evaluate succession candidate’s skills, aptitudes and behavioral traits, their work related leadership characteristics and how they will "click" at the top of the organization even if, for now, it is from a personal development point of view.

After all, succession planning and choosing the right successor is really about job suitability, isn't it?

Howard W. Coleman is a principal at MCA Associates, a management consulting firm focusing on operational excellence, leadership, and continuous improvement solutions. MCA Associates may be contacted at 203-732-0603 or by visiting: www.mcaassociates.com. E-mail Howard at: [email protected].