Step right up! Get your tax credits here! Well, at least up until Dec. 31, 2010. Due to expire at the stroke of midnight, the 30% up to a maximum of $1,500 Federal tax credit, has been a boon for business these past two years and a huge advantage for selling tax-credit-eligible products. With less than half a year to go, we'll need to sharpen our sales skills if continued sales of more expensive, higher-efficiency equipment are to continue at, or near to, the same pace.

One of the newer products available for heating domestic hot water is the concept of adding a small heat pump to pluck BTUs from the surrounding air and transfer them to the tank's water. The "magic" of the refrigerant compression cycle allows for greatly enhanced efficiency when compared to an electric-resistance-only water heater. As with all water heaters, heat pump models are also assigned an EF (Energy Factor) that can be used to project operating costs. Operating costs, once accurately projected, give you a powerful sales tool for calculating ROI and/or simple payback over an extended timeframe.

Base calculation information is required. For this example, the average incoming cold-water temperature will be 55ºF, target storage temperature is set for 120ºF, and the daily use of hot water is 60 gallons. This results in a net input of 541.45 BTUs per gallon, or 32,487 BTUs net input per day. At this point, you can begin to run yearly cost projections by incorporating water heater manufacturers’ EF-ratings, local fuel costs and BTU-ratings for fuel. The additional information below is used to nail down the final operating cost.

The formula looks like this: ((net energy input required ÷ (BTU energy per unit x EF)) x cost per unit of fuel ÷ 1,000) x 365 days = operating cost.

If we apply that to a heat pump water heater with an EF of 2.2, the numbers are as follows: ((32,487 ÷ (3.414-BTUs per W x 2.2)) x $0.114 per kWh ÷ 1,000) x 365 = $179.98.

Let's change that to the customer's existing .93 EF electric-resistance model: ((32,487 ÷ (3.414-BTUs per W x .93)) x $0.114 per kWh ÷ 1,000) x 365 = $425.76.

The heat pump model will, if allowed to operate in its most efficient mode (more on this next month), save your customer $245.78. We're going to have deregulation in 2011 with a projected increase of 37% to $0.156 per kWh. That results in the following: electric-resistance tank, $582.61; heat pump tank, $246.29; and a projected savings of $336.32. As costs for fuel rise, so do the savings, which helps make the higher-cost, energy-efficient model more attractive. Let's gussy her up a bit more!

Assume it costs $950 to install a 50-gallon electric-resistance model and $2,950 for the 50-gallon heat pump model. The cost difference is $2,000. The 30% Federal tax credit would reduce that cost difference to $1,115. The ROI is calculated by dividing the cost difference into the cost savings:

Cost savings (first year) of $245.78 ÷ $1,115 = .2204 x 100 = 22.04% ROI, which in this economy beats both the stock market and real estate as an investment.

Cost savings (second year) – no tax credits – of $336.32 ÷ $2,000 = .1682 x 100 = 16.82%, and that too is a rock-solid number for any investment.

As fuel costs rise, and they will, the ROI gets better and that’s when we can begin to project simple payback. At first-glance, the simple payback looks like a simple division equation: divide the savings into the cost difference to determine years. We know the second year savings after deregulation will be $336.32, so $2,000 ÷ 336.32 = 5.9 years. By including the 5% per year increase in fuel costs, the actual payback occurs two months earlier and if we run the calculations for 13 years, we see the following:

Cost to operate electric-resistance model = $9,699.24 Cost to operate heat-pump model = $4,100.21 Savings = $5,599.03

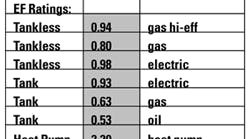

So, you might wonder, how does a heat pump water heater stack up against other types of water heaters using these same household hot-water-usage assumptions? Selling without the tax credits can be done if we present our customers with the information they need to clearly see the financial benefits beyond up-front pricing roadblocks that blind them to reality. Believe in what you sell — sell what you believe in.

Dave Yates owns F.W. Behler, a contracting company in York, Pa. He can be reached by phone at 717/843-4920 or by e-mail at [email protected].

All Dave Yates material in print and on Contractor's Web site is protected by Copyright 2010. Any reuse of this material (print or electronic) must first have the expressed written permission of Dave Yates and Contractor magazine. Please contact via email at: [email protected].